Top Reasons to Consider a Cash-Out Refinance

Top Reasons to Consider a Cash-Out Refinance

A cash-out refinance can be a powerful financial tool for homeowners looking to tap into their home equity. By refinancing your existing mortgage for a larger amount than you owe and taking the difference in cash, you can access funds for a variety of purposes. But is it the right move for you? In this article, we’ll explore the top reasons to consider a cash-out refinance, how it works, and key factors to keep in mind before making a decision.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your current mortgage with a new one for a higher amount than your remaining loan balance. The difference between the new loan amount and the existing balance is paid to you in cash, which you can use for almost any purpose. This type of refinancing is popular among homeowners who have built significant equity in their homes, especially in markets where property values have risen.

For example, if your home is worth $400,000 and you owe $200,000 on your mortgage, you might qualify to refinance for $320,000, accessing up to 80% of your home’s value (a loan-to-value ratio, or LTV, of 80%). After paying off the original $200,000, you’d receive $120,000 in cash (minus closing costs, typically 2–5% of the loan amount). In 2025, the average 30-year fixed cash-out refinance rate is around 6.95%, slightly higher than standard refinance rates by 0.125–0.25%, though FHA loans may offer rates 0.10–0.15% lower.

Unlike a home equity loan or line of credit, a cash-out refinance consolidates your debt into a single mortgage payment, often with a lower interest rate than other forms of borrowing. However, it also increases your mortgage balance and may extend your repayment term, so careful consideration is essential.

Top Reasons to Consider a Cash-Out Refinance

Here are the most compelling reasons homeowners choose a cash-out refinance, along with insights into how it can align with your financial goals.

1. Fund Home Improvements

One of the most popular uses for cash-out refinance funds is to finance home renovations or upgrades. Whether you’re dreaming of a new kitchen, adding a bathroom, or improving your home’s energy efficiency, a cash-out refinance can provide the capital needed to make it happen.

Investing in home improvements can increase your property’s value, making this a strategic use of funds. According to the 2024 Cost vs. Value Report, minor kitchen remodels yield a national average return on investment (ROI) of 96.1%, while midrange bathroom remodels offer a 73.7% ROI. These high returns are expected to persist in 2025, with renovation spending projected to rise by 1.2% as homeowners prioritize value-adding projects.

- Examples of projects: Kitchen remodels, bathroom additions, new roofing, or energy-efficient windows.

- Benefits: Increased home value, improved functionality, and enhanced comfort.

- Consideration: Focus on projects with high ROI, like kitchen or bathroom upgrades, to maximize your investment.

A cash-out refinance can fund a kitchen remodel, boosting your home’s value.

2. Consolidate High-Interest Debt

If you’re juggling credit card balances, personal loans, or other high-interest debt, a cash-out refinance can help you consolidate those obligations into a single, lower-interest mortgage payment. Mortgage interest rates are typically much lower than credit card APRs, which can exceed 20% or more.

By using the cash to pay off high-interest debt, you can save thousands in interest over time and simplify your finances. For example, paying off a $20,000 credit card balance with a 20% APR using a mortgage at 6% could significantly reduce your monthly payments and total interest costs.

Pro Tip: Be cautious about running up new credit card debt after consolidating. Create a budget to stay on track and avoid falling back into high-interest debt.

3. Cover Major Life Expenses

Life is full of big moments that come with big price tags—college tuition, medical bills, weddings, or starting a business. A cash-out refinance can provide the funds to cover these expenses without resorting to high-interest loans or depleting your savings.

For instance, if your child is heading to college, the cash from a refinance could help cover tuition costs, potentially at a lower interest rate than a private student loan. Similarly, entrepreneurs might use the funds to launch a small business, leveraging their home equity as startup missile capital.

- Common uses: College tuition, medical expenses, wedding costs, or business investments.

- Benefits: Access to large sums at competitive rates, preserving cash reserves.

- Consideration: Ensure the expense aligns with your long-term financial goals.

4. Take Advantage of Rising Home Values

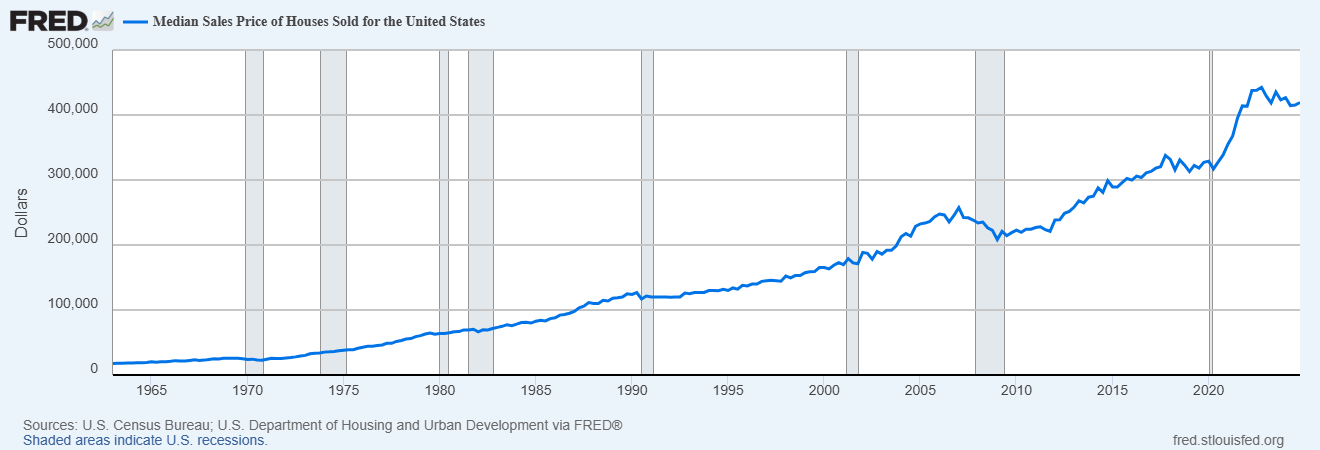

In many markets, home values have soared in recent years, significantly increasing homeowners’ equity. For example, from Q3 2020 to Q3 2021, the average homeowner gained nearly $57,000 in equity, a trend that has continued in many regions through 2025 due to sustained demand. A cash-out refinance allows you to tap into this newfound wealth without selling your home, making it an attractive option if you plan to stay in your home long term.

For instance, if your home’s value has increased by $100,000 since you purchased it, you could access up to 80% of that equity (or $80,000) through a cash-out refinance, depending on your lender’s LTV requirements. This can fund other goals, such as home upgrades or investments, but requires maintaining at least 20% equity to avoid private mortgage insurance (PMI).

Note: Home values can fluctuate, so consult with a lender to determine how much equity you can safely borrow against based on a current appraisal.

Rising home values create opportunities to access equity through a cash-out refinance.

5. Secure a Lower Interest Rate

If interest rates have dropped since you took out your original mortgage, a cash-out refinance could allow you to lock in a lower rate while accessing cash. As of April 2025, the average 30-year fixed cash-out refinance rate is approximately 6.95%, down from a January 2025 peak of 7.04%, but rates remain volatile due to inflation and Federal Reserve policies. A lower rate can reduce your monthly mortgage payments and save you money over the life of the loan, even if you borrow more than your current balance.

For example, refinancing a $250,000 mortgage from 7% to 6.95% could save you modestly on monthly payments, though savings are more significant if rates drop further. Compared to other borrowing options, cash-out refinance rates are often lower than credit card APRs (20%+) or home equity loan rates, making them a cost-effective choice for accessing funds.

However, if rates have risen since your original mortgage, this benefit may not apply. Always compare current rates with your existing mortgage rate before deciding.

6. Invest in Real Estate or Other Opportunities

For financially savvy homeowners, a cash-out refinance can provide the capital to invest in additional real estate, such as a rental property or vacation home. Real estate investments can generate passive income and appreciate over time, potentially offsetting the cost of the refinance.

Beyond real estate, some homeowners use cash-out funds to invest in the stock market, start a business, or pursue other opportunities with growth potential. However, these investments carry risks, so consult with a financial advisor to ensure they align with your risk tolerance and goals.

7. Build an Emergency Fund

An unexpected job loss, medical emergency, or major home repair can derail your finances if you’re unprepared. A cash-out refinance can help you build or replenish an emergency fund, providing a safety net for life’s uncertainties.

Financial experts recommend keeping 3–6 months’ worth of living expenses in an emergency fund. If your savings are depleted, a cash-out refinance can provide the cash needed to establish this buffer without relying on high-interest credit options.

Key Considerations Before Choosing a Cash-Out Refinance

While a cash-out refinance offers many benefits, it’s not without risks. Here are some factors to evaluate before moving forward:

- Increased Debt: You’ll owe more on your mortgage, which could extend your repayment term or increase monthly payments.

- Closing Costs: Refinancing typically involves fees of 2–5% of the loan amount, reducing the cash you receive. For example, on a $300,000 loan, expect $6,000–$15,000 in costs.

- Risk to Your Home: Since your home secures the loan, failure to make payments could lead to foreclosure.

- Equity Reduction: Borrowing against your equity reduces your ownership stake in the home, which could impact future financial flexibility. Most lenders require at least 20% equity to remain (25–30% for investment properties).

- Interest Rate Changes: In 2025, rates are expected to hover around 6.5–6.7% for 30-year fixed loans, with potential volatility due to economic factors. If rates rise, your new mortgage rate may be higher than your current one.

- Credit Requirements: A credit score of 620–640 is typically required, but scores of 740 or higher secure the best rates.

To make an informed decision, consult with a mortgage lender, review your financial goals, and compare offers from multiple lenders to secure the best terms.

Careful planning is essential before pursuing a cash-out refinance.

Is a Cash-Out Refinance Right for You?

A cash-out refinance can be a smart financial move if you have clear goals, sufficient equity, and a plan to manage the increased debt. Whether you’re looking to renovate your home, pay off high-interest debt, or fund a major life event, this strategy offers flexibility and competitive interest rates compared to other borrowing options.

However, it’s not a one-size-fits-all solution. Take the time to assess your financial situation, weigh the pros and cons, and seek professional advice if needed. By doing so, you can ensure that a cash-out refinance aligns with your long-term financial objectives.

Ready to explore your options? Contact a trusted mortgage lender to discuss your eligibility and start planning your next steps.