What Are the Costs and Fees of a Cash-Out Refinance?

What Are the Costs and Fees of a Cash-Out Refinance?

A cash-out refinance can be a powerful financial tool, allowing homeowners to tap into their home’s equity for cash while refinancing their existing mortgage. However, like any financial product, it comes with costs and fees that can significantly impact the overall expense. Understanding these costs is crucial to determining whether a cash-out refinance is the right move for you. In this comprehensive guide, we’ll break down the various costs and fees associated with a cash-out refinance, provide tips for minimizing expenses, and help you make an informed decision.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new, larger loan. The difference between the old mortgage balance and the new loan amount is paid to you in cash, which you can use for purposes like home improvements, debt consolidation, or other financial needs. Because this process involves taking on a new mortgage, it comes with many of the same costs as an original home loan, plus some unique considerations due to the cash-out component.

Key Costs and Fees of a Cash-Out Refinance

The costs of a cash-out refinance can be broadly categorized into closing costs, interest-related expenses, and other fees. Below, we’ll explore each category in detail.

1. Closing Costs

Closing costs are the fees you pay to finalize your refinance. They typically range from 2% to 6% of the loan amount, depending on the lender, loan size, and location. For a $300,000 loan, this could mean $6,000 to $18,000 in closing costs. These costs are often rolled into the loan balance, increasing the amount you owe. Common closing costs include:

- Origination Fees: Charged by the lender for processing the loan, usually 0.5% to 1% of the loan amount.

- Appraisal Fees: An appraisal is required to determine your home’s current value, costing $300 to $600.

- Title Insurance: Protects against issues with the property’s title, typically costing $500 to $1,500.

- Credit Report Fees: Lenders pull your credit report, which may cost $20 to $50.

- Recording Fees: Paid to the local government to record the new mortgage, usually $50 to $200.

- Attorney Fees: In some states, an attorney is required for closing, adding $500 to $1,500.

Pro Tip: Ask your lender for a no-closing-cost refinance, where fees are covered by a higher interest rate. This can reduce upfront costs but may increase long-term expenses.

2. Interest Rates

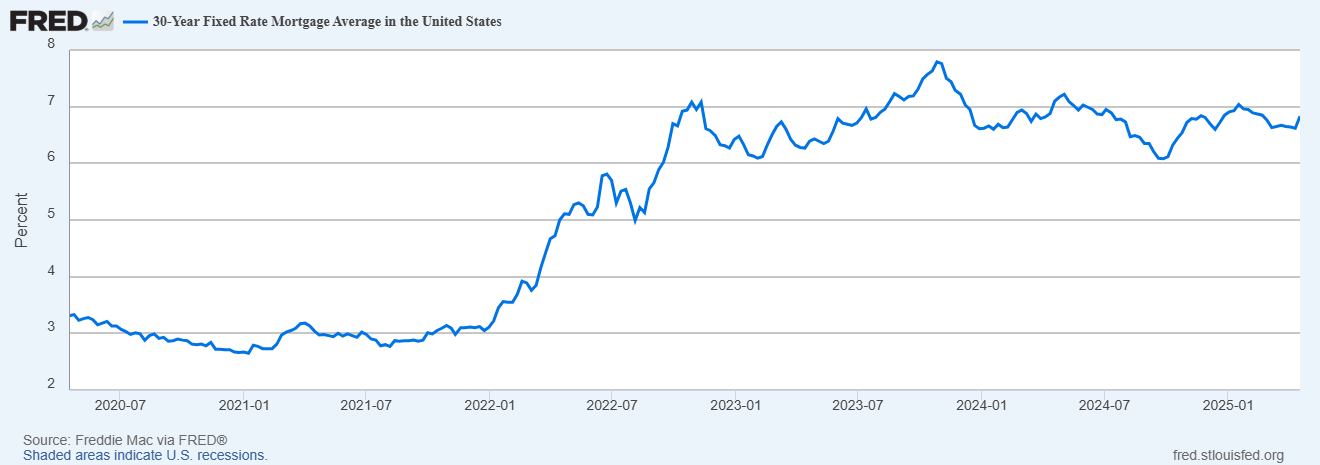

Cash-out refinances often come with higher interest rates than standard refinances or purchase loans. Lenders view cash-out loans as riskier because you’re borrowing more against your home’s equity. On average, interest rates for cash-out refinances may be 0.25% to 0.5% higher than for rate-and-term refinances. For example, if a standard refinance has a 6% rate, a cash-out refinance might be 6.25% to 6.5%.

The interest rate directly affects your monthly payment and the total cost of the loan over time. For a $300,000 loan with a 30-year term, a 0.5% rate increase could add $100 to $150 to your monthly payment and tens of thousands of dollars in interest over the loan’s life.

3. Private Mortgage Insurance (PMI)

If your cash-out refinance increases your loan-to-value (LTV) ratio above 80%, you may need to pay PMI. PMI protects the lender if you default and typically costs 0.5% to 1.5% of the loan amount annually. For a $300,000 loan, this could mean an additional $1,500 to $4,500 per year until you rebuild enough equity.

4. Prepayment Penalties

Some mortgages include prepayment penalties, which are fees for paying off the loan early. Since a cash-out refinance pays off your existing mortgage, you could face a penalty if your original loan has this clause. Penalties vary but may be a percentage of the remaining balance or a set number of months’ interest, such as 2% of the balance or six months’ interest.

5. Other Potential Fees

Depending on your lender and location, you may encounter additional fees, such as:

- Application Fees: Some lenders charge $100 to $500 to process your application.

- Survey Fees: If a property survey is required, expect to pay $200 to $400.

- Escrow Fees: Fees for managing escrow accounts, typically $200 to $500.

Factors That Influence Cash-Out Refinance Costs

Several factors can affect the total cost of your cash-out refinance. Understanding these can help you anticipate expenses and shop for the best deal.

1. Loan Amount

Larger loans typically have higher closing costs because many fees are calculated as a percentage of the loan amount. A $500,000 loan will have higher origination and title fees than a $200,000 loan.

2. Credit Score

Your credit score plays a significant role in determining your interest rate and eligibility for favorable terms. Borrowers with scores above 740 often qualify for the lowest rates, while those below 680 may face higher rates or additional fees.

3. Loan-to-Value (LTV) Ratio

The LTV ratio compares your loan amount to your home’s value. A higher LTV (e.g., above 80%) increases the lender’s risk, potentially leading to higher rates or PMI requirements.

4. Lender Policies

Different lenders have varying fee structures and interest rates. Some may offer lower fees but higher rates, while others charge more upfront but provide better long-term savings.

5. Location

Closing costs vary by state due to differences in taxes, title insurance rates, and legal requirements. For example, states like New York and California often have higher closing costs than states like Texas or Florida.

How to Minimize Cash-Out Refinance Costs

While some costs are unavoidable, there are strategies to reduce the financial burden of a cash-out refinance:

- Shop Around: Compare offers from multiple lenders to find the best rates and lowest fees. Use a loan estimate form to evaluate total costs.

- Negotiate Fees: Some fees, like origination or application fees, may be negotiable. Ask your lender to waive or reduce them.

- Improve Your Credit: Boost your credit score before applying to qualify for lower rates and avoid PMI.

- Consider a No-Closing-Cost Refinance: Opt for a higher rate to eliminate upfront fees, but calculate the long-term cost to ensure it’s worthwhile.

- Use the Same Lender: Your current lender may offer discounts or waive certain fees to retain your business.

Did You Know? Rolling closing costs into your loan can reduce out-of-pocket expenses but increases your loan balance and interest payments over time.

Is a Cash-Out Refinance Worth the Costs?

Deciding whether a cash-out refinance makes sense depends on your financial goals and the costs involved. Here are some scenarios where it may be worthwhile:

- Debt Consolidation: Using the cash to pay off high-interest credit card debt can save money if the new mortgage rate is lower than the debt’s interest rate.

- Home Improvements: Investing in renovations that increase your home’s value can justify the costs, especially if you plan to sell in the future.

- Emergency Funds: Accessing cash for unexpected expenses, like medical bills, can provide financial relief.

However, a cash-out refinance may not be ideal if:

- The costs outweigh the benefits, such as when interest rates are high.

- You plan to sell your home soon, as you may not recoup the closing costs.

- You’re reducing your home equity significantly, increasing financial risk.

Conclusion

A cash-out refinance can provide valuable access to your home’s equity, but it’s not without costs. Closing costs, higher interest rates, PMI, and other fees can add up, making it essential to understand the full financial picture before proceeding. By shopping around, negotiating fees, and carefully weighing the benefits against the costs, you can make an informed decision that aligns with your financial goals. Always consult with a trusted lender or financial advisor to explore your options and ensure a cash-out refinance is the right choice for you.