How Cash-Out Refinances Work: A Step-by-Step Guide

How Cash-Out Refinances Work: A Step-by-Step Guide

A cash-out refinance can be a powerful tool for homeowners looking to access their home equity for financial goals, such as home improvements, debt consolidation, or major life expenses. But how does it work, and what steps are involved? In this comprehensive guide, we’ll walk you through the cash-out refinance process step by step, explain key considerations, and provide 2025 market insights to help you make an informed decision.

A cash-out refinance lets you tap into your home’s equity for financial flexibility.

What Is a Cash-Out Refinance?

A cash-out refinance replaces your existing mortgage with a new one for a higher amount than you owe, allowing you to receive the difference in cash. This cash can be used for nearly any purpose, from renovating your home to paying off high-interest debt. It’s a popular option for homeowners with significant equity, especially in markets where home values have risen.

For example, if your home is valued at $400,000 and you owe $200,000, you might refinance for $320,000, accessing up to 80% of your home’s value (a loan-to-value ratio, or LTV, of 80%). After paying off the $200,000, you’d receive $120,000 in cash, minus closing costs (typically 2–5% of the loan amount). As of April 2025, the average 30-year fixed cash-out refinance rate is approximately 6.95%, slightly higher than standard refinance rates by 0.125–0.25%.

Unlike a home equity loan, which adds a second mortgage, a cash-out refinance consolidates your debt into one loan, often with a lower interest rate than other borrowing options. However, it increases your mortgage balance and may extend your repayment term, so understanding the process is crucial.

Why Consider a Cash-Out Refinance?

Before diving into the steps, it’s helpful to understand why homeowners choose cash-out refinances. Common reasons include:

- Home Improvements: Funding renovations, like kitchen remodels, which offer a 96.1% ROI according to the 2024 Cost vs. Value Report.

- Debt Consolidation: Paying off high-interest credit card debt (20%+ APR) with a lower-rate mortgage.

- Major Expenses: Covering college tuition, medical bills, or business startups.

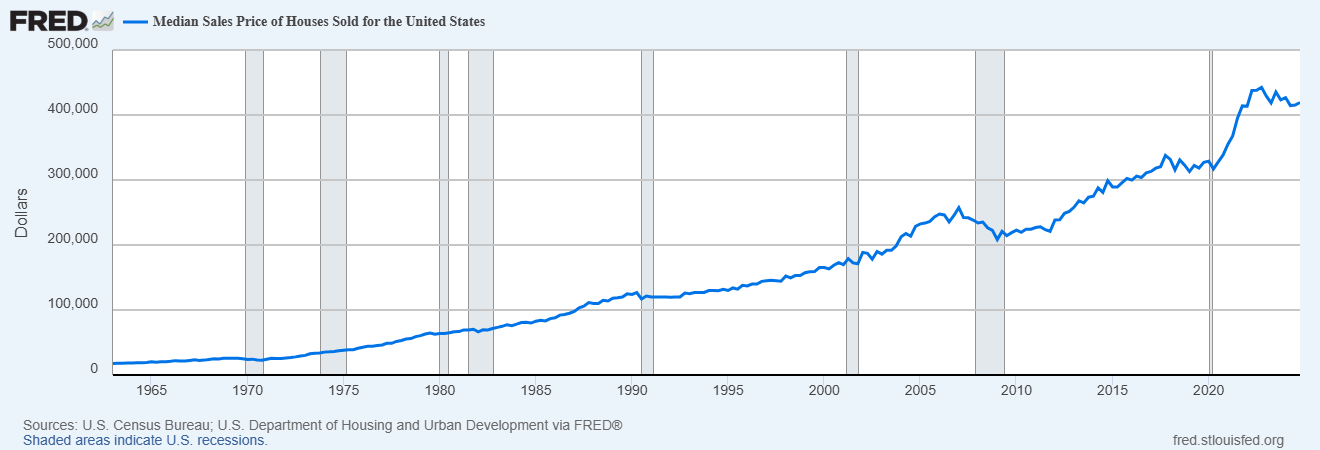

- Equity Access: Tapping into an average $57,000 equity gain per homeowner (2020–2021 trends continuing into 2025).

With 2025 renovation spending projected to rise by 1.2%, cash-out refinances are increasingly popular for value-adding projects. However, the process requires careful planning to ensure it aligns with your financial goals.

Renovations like kitchen remodels can boost home value with high ROI.

Step-by-Step Guide to a Cash-Out Refinance

The cash-out refinance process involves several steps, from assessing your eligibility to closing the loan. Here’s a detailed breakdown to guide you through each stage.

Step 1: Assess Your Financial Goals and Equity

Start by defining why you want a cash-out refinance. Are you renovating your home, consolidating debt, or funding a major expense? Your goals will determine how much cash you need and whether refinancing makes sense.

Next, evaluate your home equity. Most lenders allow you to borrow up to 80% of your home’s value (75% for investment properties), requiring you to maintain at least 20% equity to avoid private mortgage insurance (PMI). For example, a $400,000 home with a $200,000 mortgage balance has $200,000 in equity, allowing you to borrow up to $120,000 (80% LTV) minus closing costs.

Tip: Use an online home value estimator or consult a real estate agent to gauge your home’s current market value before proceeding.

Step 2: Check Your Credit and Finances

Lenders require a minimum credit score of 620–640 for cash-out refinances, with scores of 740 or higher securing the best rates (e.g., closer to 6.5% vs. 7% in 2025). Review your credit report for errors and pay down high-interest debt to improve your score.

Assess your debt-to-income (DTI) ratio, which should ideally be below 43%. Calculate your DTI by dividing your monthly debt payments (e.g., mortgage, car loans) by your gross monthly income. A lower DTI increases your approval odds.

Finally, ensure you have stable income and at least 3–6 months of savings to cover unexpected expenses, as lenders will verify your employment and financial stability.

Step 3: Compare Lenders and Loan Options

Shop around to find the best cash-out refinance terms. Compare interest rates, fees, and lender requirements. In 2025, conventional loans average 6.95%, while FHA cash-out refinances may offer rates 0.10–0.15% lower, though they require mortgage insurance premiums (MIP).

- Conventional Loans: Best for borrowers with strong credit and 20%+ equity.

- FHA Loans: Ideal for lower credit scores (580+) but include MIP.

- VA Loans: Available for eligible veterans, often with no PMI and competitive rates.

Request quotes from at least three lenders and ask about closing costs (2–5% of the loan amount, or $6,000–$15,000 on a $300,000 loan). Some lenders offer “no-closing-cost” refinances, but these often come with higher rates.

Step 4: Get a Home Appraisal

Once you select a lender, they’ll require a professional appraisal to determine your home’s current market value. This step is critical, as it dictates how much equity you can access. In 2025, rising home values have boosted equity, with homeowners gaining an average of $57,000 from 2020–2021, a trend continuing in many markets.

Appraisals typically cost $300–$500 and take 1–2 weeks. Ensure your home is in good condition (e.g., clean, minor repairs completed) to maximize its appraised value. If the appraisal comes in lower than expected, you may need to adjust your loan amount or appeal the appraisal.

Step 5: Submit Your Application and Documentation

After the appraisal, complete the lender’s loan application. You’ll need to provide documentation, including:

- Proof of income (e.g., pay stubs, W-2s, or tax returns for two years).

- Bank statements (2–3 months).

- Credit report authorization.

- Current mortgage statement.

- Proof of homeowners insurance.

Be prepared for additional requests, especially if you’re self-employed or have complex finances. The lender will verify your information and assess your ability to repay the new loan. Learn more about preparing for the mortgage application process.

Step 6: Underwriting and Loan Approval

During underwriting, the lender evaluates your application, appraisal, and financial documents to ensure you meet their criteria. This process typically takes 1–4 weeks, depending on the lender and market demand in 2025. Underwriters will check your credit, DTI, LTV, and income stability.

If approved, you’ll receive a loan estimate detailing the interest rate, monthly payments, and closing costs. Review this carefully and ask questions if anything is unclear. If denied, the lender will provide reasons (e.g., low credit score, high DTI), allowing you to address issues and reapply.

Step 7: Close the Loan

Once approved, you’ll schedule a closing appointment, either in person or remotely (e-signing is common in 2025). At closing, you’ll sign the new mortgage documents, pay closing costs (unless rolled into the loan), and receive the cash-out funds, typically via wire transfer or check within 1–3 days.

You’ll have a three-day right of rescission for primary residences, during which you can cancel the loan without penalty. After this period, the new mortgage replaces your old one, and you begin making payments on the new loan.

Rising home values in 2025 increase equity for cash-out refinances.

Key Considerations Before Refinancing

A cash-out refinance can provide significant financial flexibility, but it’s not without risks. Consider the following before proceeding:

- Increased Debt: Your new mortgage balance will be higher, potentially increasing monthly payments or extending the loan term.

- Closing Costs: Expect to pay 2–5% of the loan amount ($6,000–$15,000 on a $300,000 loan), which reduces your cash proceeds.

- Interest Rates: In 2025, cash-out refinance rates average 6.95%, down from 7.04% in January, but volatility persists due to inflation and Federal Reserve policies.

- Equity Reduction: Borrowing against your equity lowers your homeownership stake, which may limit future borrowing options.

- Risk of Foreclosure: Your home secures the loan, so missed payments could lead to foreclosure.

- Credit Impact: A credit score below 740 may result in higher rates, and multiple lender inquiries can temporarily lower your score.

Weigh these factors against your goals. For example, funding a kitchen remodel with a 96.1% ROI may justify the costs, while using cash for discretionary spending may not.

Is a Cash-Out Refinance Right for You?

A cash-out refinance can be a smart strategy if you have sufficient equity, a clear plan for the funds, and the ability to manage a larger mortgage. In 2025, with home values continuing to rise and refinance rates stabilizing around 6.5–6.7% for top borrowers, it’s an opportune time for many homeowners to explore this option.

However, it’s not a one-size-fits-all solution. Consult a mortgage lender to assess your eligibility, compare rates, and calculate the long-term costs. By understanding the process and market conditions, you can decide if a cash-out refinance aligns with your financial objectives.

Ready to take the next step? Contact a trusted lender to explore your options and start the refinancing process today.

Consulting a lender helps you navigate the cash-out refinance process.